Closing of the transaction is scheduled for June 30th, 2021. The property was completed at the end of 2020. The asset comprises a total area of approximately 4 300 sqm and contains 60 apartments, divided into six units. The care home is operated by Vardaga (Ambea) under a 15-year lease agreement.

We are very excited to announce the acquisition of the care home property in this brand-new district in central Kalmar. There is a growing need for modern aged care facilities across Sweden and we have been looking to invest in Kalmar for a while. The vision for this district fits perfectly with our investment strategy so we are very pleased to add this property to our portfolio, comments Jonas Nolin, Investment Director, Northern Horizon Sweden.

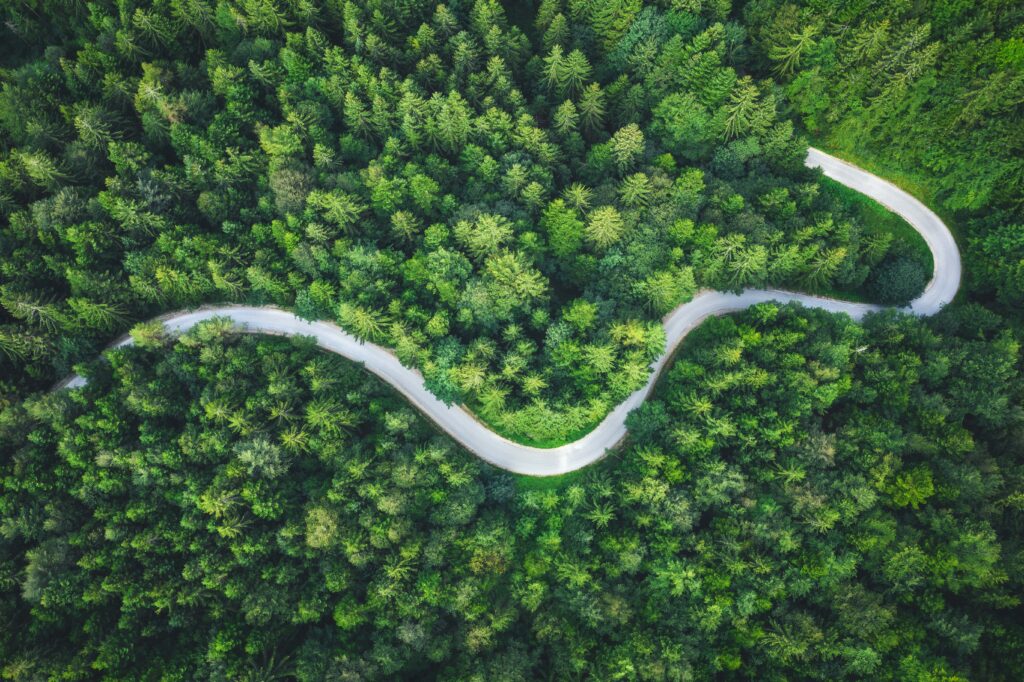

Sustainability is at the core of our investment strategy, and besides from being modern and well-located, the new aged care home in Kalmar also complies with the ambitious ESG targets that we have for the Fund assets, adds Riikka Moreau, Fund Manager in charge of Aged Care for Northern Horizon.

About Northern Horizon

Northern Horizon is an independent real asset manager with a strategic focus on the elderly care sector in the Nordic region. Since 2007, Northern Horizon has acquired more than 120 care homes across the Nordics.

Northern Horizon manages real estate funds and separate accounts with over EUR 1billion in assets for leading European financial institutions and private wealth capital including pension funds, insurance companies, banks, asset managers, corporate investors, charity foundations and family offices. https://www.nh-cap.com

About Nordic Aged Care Fund

Nordic Aged Care was launched in 2016 and it is Northern Horizon’s third specialized care home fund. The Fund helps the Nordic countries meet the challenge of a rapidly ageing population by funding the development of modern and high-quality care homes. The Fund raised EUR300 million of equity and is fully committed.