Investors around the world have become attracted to the aged care sector in the Nordic countries for a variety of reasons and are increasing fundraising and investment in the sector, including open-end private equity fundraising. Evergreen funds are particularly suited to these assets due to their long leases of up to 30 years, inflation-linked rental rates and near 100 percent economic occupancy, explain Northern Horizon’s CEO Christoffer Abramson and Andrew Smith, partner and head of capital raising at the Nordic-based firm.

Q How is the rapidly aging population in the Nordics affecting the supply of specialized care beds?

Christoffer Abramson: The Nordic region is facing a real demographic crisis and the need for new investments in modern care homes is pressing. Sweden, Denmark, Norway and Finland have a combined population of 28 million, and over the next 25 years, the 75-plus population is expected to grow by 75-80 percent, and the 85-plus cohort by up to 85-95 percent, virtually doubling both age brackets in the coming decades. We are already seeing a significant undersupply of care beds, and calculations show that until 2050, we will need over 185,000 net new care beds. This corresponds to over €3 billion in annual investment. Helping society care for our elders and alleviating this massive structural shortage are key drivers for our strategy.

Q Why is social infrastructure in the Nordic region an especially attractive investment proposition?

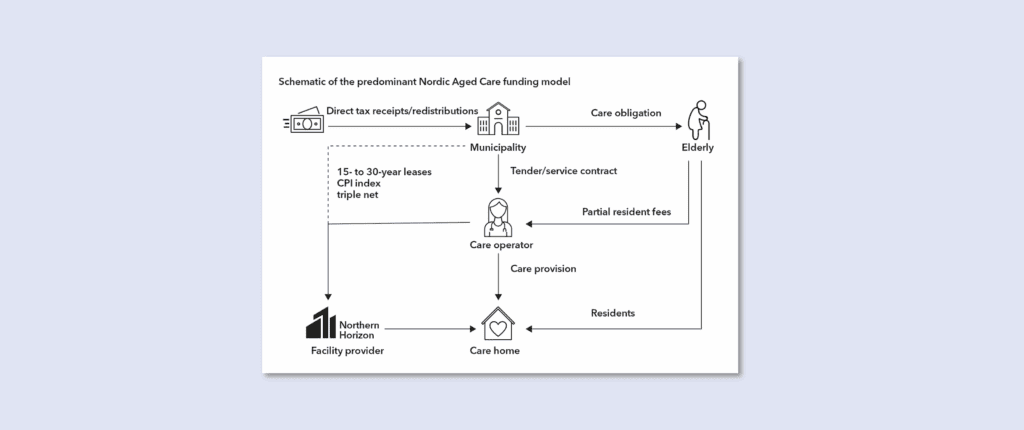

Andrew Smith: The Nordics are known for cradle-to-the-grave welfare states and a funding structure unique in Europe. Social welfare services are provided free of charge to citizens in need, requiring substantial and ongoing investment in high-quality, purpose-built care homes. The system is underpinned by a publicly funded care model, where municipalities provide secure, inflation-linked income streams through long-term, triple-net leases. Moreover, Nordic governments maintain surplus funding and very low debt ratios, ensuring social welfare commitments are met.

Combined with political and regulatory stability, transparent legal frameworks and strong governance, this model supports occupancy stability and development opportunities. Many assets also meet high ESG standards, aligning with the EU’s Sustainable Finance Disclosure Regulation (Article 8) and net-zero targets – an increasingly important factor for institutional investors. Together, these characteristics reduce risk while delivering investors predictable cashflows, inflation protection and attractive risk-adjusted returns.

Q What are the key obstacles that investors in the aged-care sector face in the Nordic region?

CA: Any planning process takes time, but governments in the Nordics are becoming increasingly proactive in ensuring that new urban developments incorporate essential social infrastructure. This integrated approach supports the aged-care sector, meaning that access to land is not a major bottleneck. Instead, the constraints lie in the speed of planning permits, construction and the flow of capital needed.

Another challenge is that not all municipalities are yet open to private competition in aged care, but we expect this to change over time. Much of the existing care infrastructure is outdated and requires replacement, while waiting lists continue to far exceed capacity.

AS: In Sweden, every municipality must ensure that aged-care beds are supported by government funding, resulting in relatively consistent underlying risk across the country. Although land in major cities like Stockholm is undoubtedly more expensive, most projects arise from collaboration with residential developers seeking planning permission for large-scale housing developments, and rents achieved there are higher. We play a crucial role as a facilitator, working closely with developers to integrate essential care infrastructure into urban plans. This collaborative approach helps bridge the gap between rising demand and limited supply.

However, operators continue to face capital constraints due to asset-light business models, while municipalities often struggle with the scale and complexity of demographic pressures. As a result, there is an increasing need for private investors to contribute with capital and experience.

Northern Horizon works together with UBS Investment Bank as its placement agent, and in early September, we raised €220 million for our flagship Aged Care and Social Infrastructure Fund, bringing total fund equity to over €600 million. One of the largest vehicles of its kind in Europe, ACSIF will reach gross asset value of €1 billion in early 2026 as it continues to build on three predecessor funds.

Our new fund seeks to capitalize on the long-term structural supply-demand imbalance for aged care facilities in the Nordic region, targeting properties with long useful lives that are leased to high-quality tenants under long-term, inflation-linked agreements.

Q Are you now seeing more competition in the Nordic aged-care investment space given the supply-demand imbalance?

CA: Competition in the Nordic aged care market has intensified as institutional public and private investors, along with local pension funds, municipalities and select family offices, enter the landscape. As investment activity continues to rise, there is an ongoing shift from public to private ownership and operation, creating opportunities for consolidation in a market where size drives enhanced returns.

This trend has attracted more professional capital. However, with a 20-year expertise in the sector, Northern Horizon maintains an edge through its niche focus, as no other investible funds offer a ‘pure play’ in Nordic aged care with its globally unique risk/return profile.

AS: Most alternative vehicles are either broader pan-European healthcare strategies, often focused on private pay, or diversified Nordic core/core-plus funds, leading to narrower competition for similar assets. ACSIF is a specialist player that has been recognized as a global and regional sector leader in the non-listed healthcare category of the Global Real Estate Sustainability Benchmark for standing investments, with the maximum five-star rating.

ESG compliance is embedded into our strategy, and we require our assets to achieve BREEAM certification of Good or Very Good, or an equivalent local standard. And with over €3 billion of investment required every year, there is a lot of room to grow for everyone.

Q How can investors and managers best source acquisitions in the sector and what are their investment criteria?

AS: We have recently acquired eight assets across Sweden, Finland and Denmark, totaling €147 million, with a further €70 million in the committed pipeline. Most of our assets – over 95 percent – are acquired off-market through our relationship-driven approach, which allows us to leverage our local presence in each country.

By fostering strong connections with municipalities, developers and care operators, we gain early access to opportunities that help reduce auction pressure and pricing risk. We also team up with developers and municipalities on fully de-risked forward purchase agreements for pre-let, purpose-built assets, with developers taking on the construction risk. This strategy results in a continuously refreshed pipeline of around €600 million in actionable opportunities.

In addition to ESG compliance, we prioritize newly purpose-built care homes, which attract top-tier operators and staff, deliver an exceptional resident experience and ensure lasting durability. Tenant quality is equally critical, and we favor only reputable private or public operators with proven operational performance and strong financials. Lease structures are also key, and our preference is for long-term, upward-only and inflation-linked triple-net agreements.

CA: Other decisive factors are strong connectivity via public transport and road networks, supportive local political environments and positioning in primary or secondary cities. Finally, we target urban areas with a growing elderly population and a current and projected shortage of care beds, ensuring sustained demand for high-quality facilities.

Q What is the ongoing appetite for senior living/social infrastructure in the region from both European and global investors?

AS: Our current investor base includes asset managers, investment managers, consultants and pension funds. ACSIF has recently received commitments from Helaba Invest and KZVK Dortmund, the pension provider for employees of church organizations in the Westphalia and Rhineland regions in Germany.

European and global investors are already invested via multi-managers, such as UBS Asset Management and Townsend, and we are now sounding out new markets, including the Netherlands, Japan and Australia.

We expect to raise a further €200 million to €300 million in the first half of 2026.

CA: One of the key attractions for investors is the fund’s 5 percent cash-on-cash return, combined with a core risk profile and value-add upside potential of around 14 percent net IRR. Our core-plus cash return offers a significant yield premium – approximately 175-225 basis points over government bonds and 100-150bps over residential assets.

While capital raising remains challenging, particularly for core strategies, healthcare and social infrastructure in Europe are increasingly viewed as a secure, stable investment supported by strong demographic trends and government funding.

As a Swede, I take great pride in our aged-care system, which focuses on providing the elderly and vulnerable with dignity and a high quality of life, creating living environments that embody the kind of society we aspire to build for future generations. This vision also resonates deeply with our investors.

Download a pdf version of the keynote interview

Marketing Communications

This document is not a contractually binding document, or an information document required by any legislative provision, and is not sufficient to take an investment decision. This is a marketing communication for PROFESSIONAL INVESTORS only. Please refer to the legal and regulatory documentation of Northern Horizon Aged Care Social Infrastructure SCSp SICAV-RAIF before making any final investment decisions.

Investing involves risks. Real estate investments are highly illiquid and designed for professional investors pursuing a long-term investment strategy only. The value of an investment and the income associated with it can go down as well as up. Investors may not get back the full amount invested. Past performance is not a reliable indicator of future results. The views and opinions expressed herein, which are subject to change without notice, are the views and opinions of Northern Horizon at the time of publication.